Renters Insurance in and around Mountain Home

Renters of Mountain Home, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

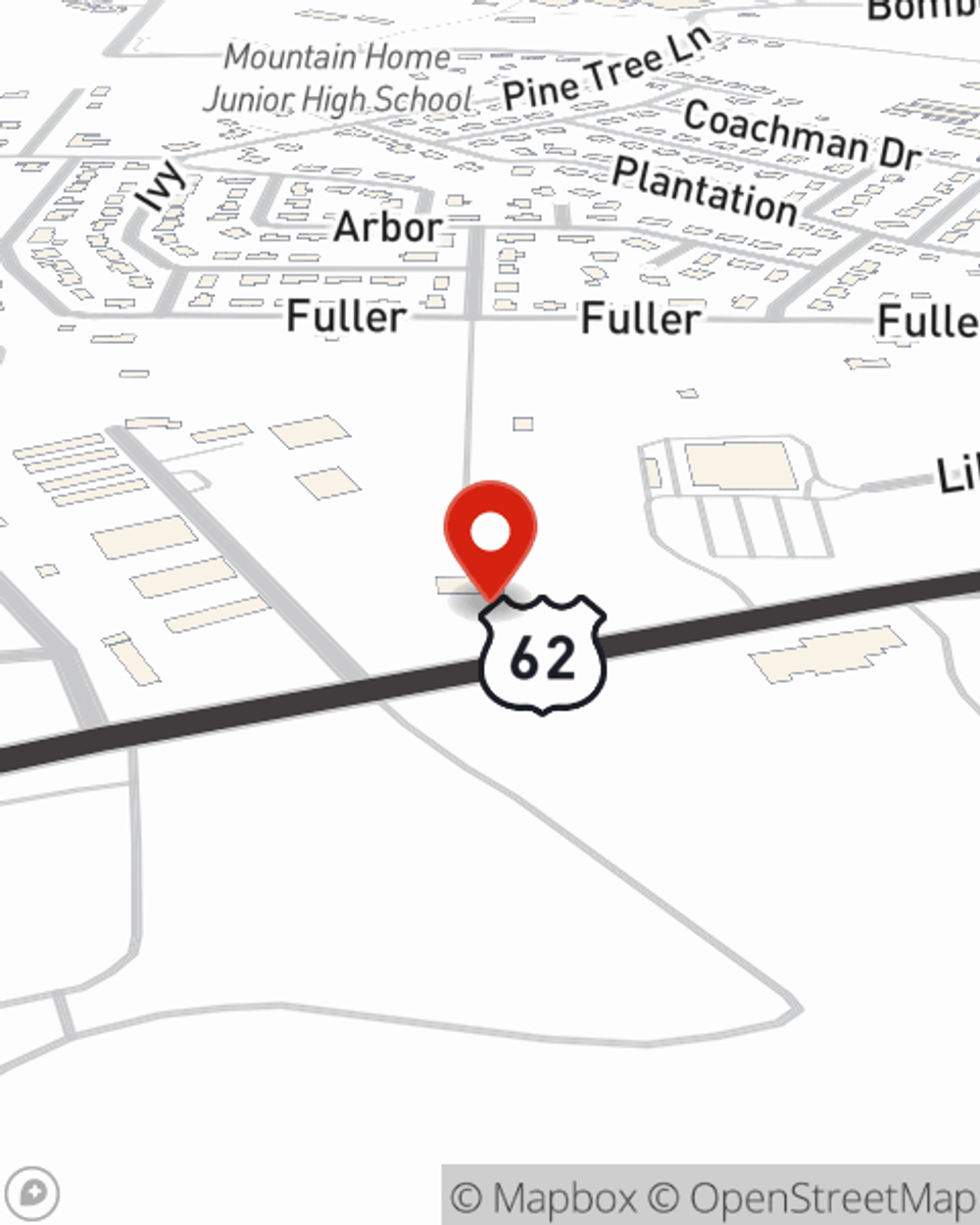

There are plenty of choices for renters insurance in Mountain Home. Sorting through providers and savings options to pick the right one is a lot to deal with. But if you want economical renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unmatched value and no-nonsense service by working with State Farm Agent Ashley Havens. That’s because Ashley Havens can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including swing sets, souvenirs, videogame systems, jewelry, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Ashley Havens can be there to help whenever trouble knocks on your door, to get your homelife back to normal. State Farm provides you with insurance protection and is here to help!

Renters of Mountain Home, State Farm can cover you

Renters insurance can help protect your belongings

Why Renters In Mountain Home Choose State Farm

You may be wondering: Is having renters insurance beneficial? Imagine for a minute the cost of replacing your personal property, or even just a few high-cost things. With a State Farm renters policy in your pocket, you won't waste time worrying about thefts or accidents. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Ashley Havens can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a reliable provider that can help with all your renters insurance needs, call or email State Farm agent Ashley Havens today.

Have More Questions About Renters Insurance?

Call Ashley at (870) 492-2450 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Ashley Havens

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.